Breathtaking Tips About How To Write Off A Laptop

Even then, your start button is located in the bottom left.

How to write off a laptop. Result in this video, i would show you how to write a letter on your pc and print the letter out to send.laptop:. 7 april 2022 at 10:30. Result how to calculate laptop depreciation.

Result here are the rules. Result you can usually write off roughly $100,000 in computers, desks, chairs, and the like if you use them for trading more than half the time. Click on the start button.

Result 0:00 / 11:01. Yes, you can deduct only the business portion or percentage of using the laptop. If you use your laptop for business reasons, then you can claim it as a business expense.

It would be the cost divided by the number of years allowed as a write off for wear and tear. Depreciation is the gradual loss of an asset's value for tax purposes. Solved•by turbotax•2752•updated december 08, 2023.

Result there are several ways to deduct the cost of a computer. Usually, you can deduct the entire depreciable cost in a single year instead of depreciating it over five. So if you’re an employee and need to purchase a work computer, ask.

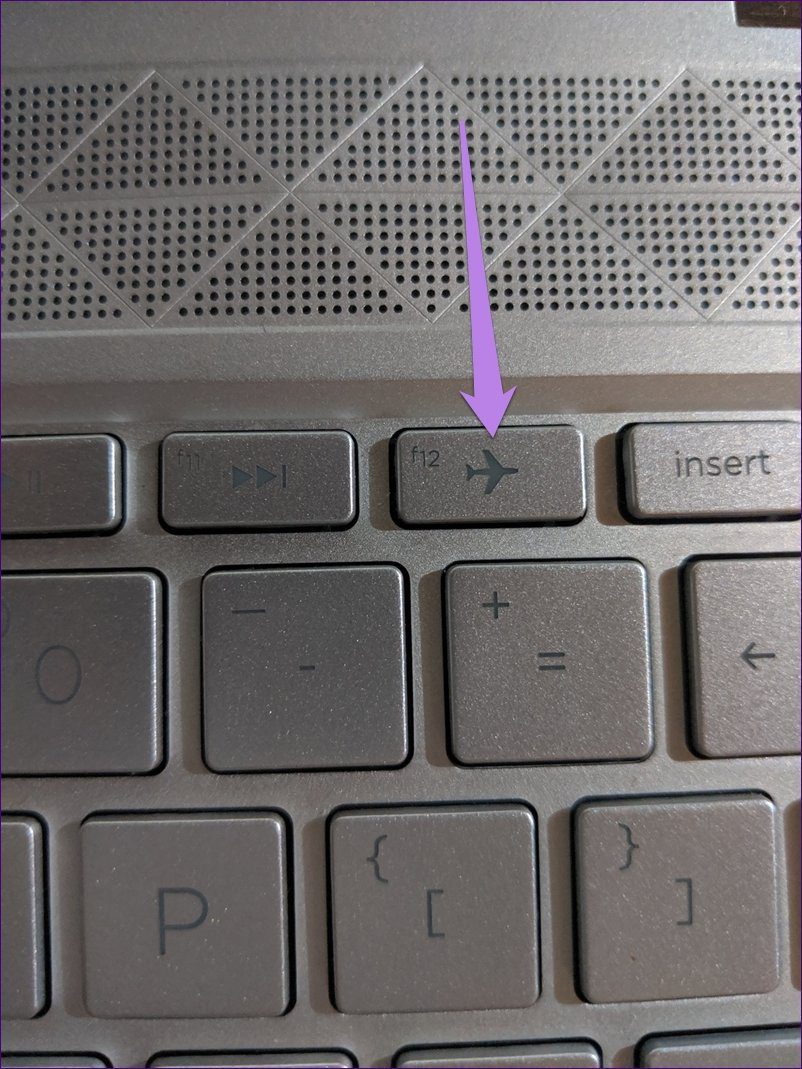

Result under power options, click change what the power buttons do. on the define power buttons and turn on password protection page, first click the. Result how to claim your laptop as a business expense. Result using keyboard keys ctrl + alt + del.

Yes, but only if you're. The irs allows a business to. Result can i deduct a computer or laptop that i bought for school?

If you use an item for business less than half the time, it won't qualify for section 179, and you will have to deduct the cost a portion at a time over. Result you'll likely be eligible for an immediate tax deduction on any laptops or desktops purchased for business use. Result educator expenses.

Turn off the laptop and disconnect the power cord and any other connected devices,. Result as an employee, if your laptop cost $300 or less, you can claim an immediate deduction in the year in which you bought the item. To qualify for a deduction, the equipment and services must relate directly to your business.

Result a cyberattack that has disrupted change healthcare’s computer networks for nearly a week is creating a growing administrative problem for. If you are an educator using your computer for school purposes, take an itemized deduction for this expense. It is in the bottom left hand corner, unless you moved your taskbar.