Cool Info About How To Claim For Baby Bonus

Baby bonus scheme.

How to claim for baby bonus. For eligible children born on or after 14 february 2023] the baby bonus scheme helps you manage the costs of raising a child. The baby bonus is paid to carers who have an adjusted taxable income of less than or equal to $75,000 in the six months after the birth or adoption of the child. Raising kids having a baby top payments newborn upfront payment and newborn supplement who can get it who can get it you may be eligible for newborn upfront.

A baby bonus is a government payment to parents of a newborn baby or adopted child to assist with the costs of childrearing. The “baby bonus” was canada’s first universal welfare program, and in its short history it has been rolled out to keep infants from dying, possibly put the brakes. If your child was stillborn or died shortly after birth, help is available.

A lump sum and an increase to your family tax benefit part a payment when you start caring for a baby or child that's. Singsaver's exclusive offer: If you have a baby, you may be eligible to get newborn upfront payment and newborn supplement.

The postnatal allowance can be. How to join the baby bonus scheme. A south korean firm is offering employees up to $75,000 to have children and help lift the country's ailing birth rate.

Getty) (twomeows via getty images) singapore —. This is an ongoing payment for up to 13 weeks. You must lodge your baby bonus claim with us no later than 52 weeks (364 days) from the day after the birth of your child or in the case of adoption, no later than 52 weeks (364.

The allowance ranges from €80 to €160 euro per month for first children, based on the isee requirements of the. When you claim family tax benefit (ftb) for your child we’ll check if you’re eligible for newborn upfront payment and newborn supplement. Newborn supplement this is an ongoing payment for up to 13 weeks.

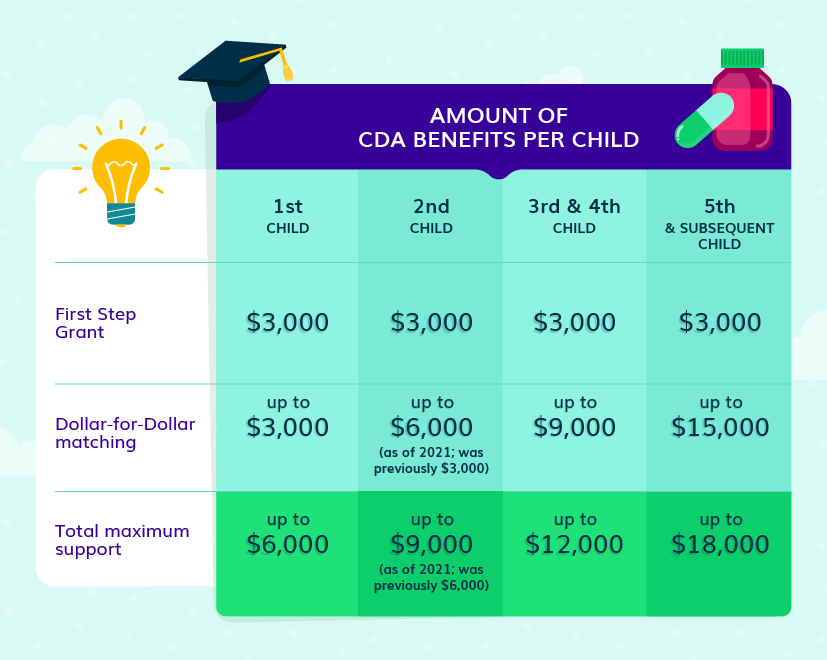

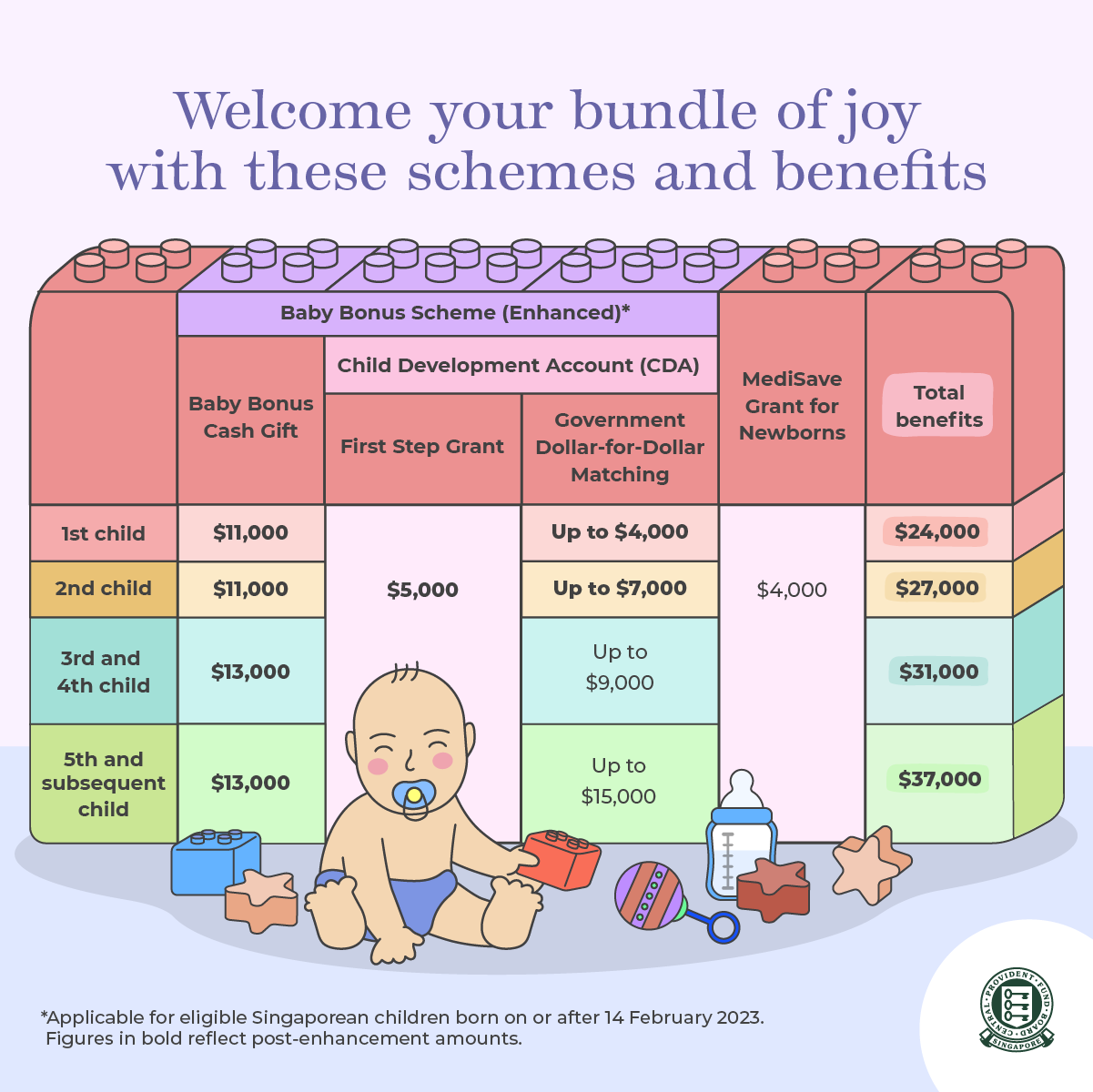

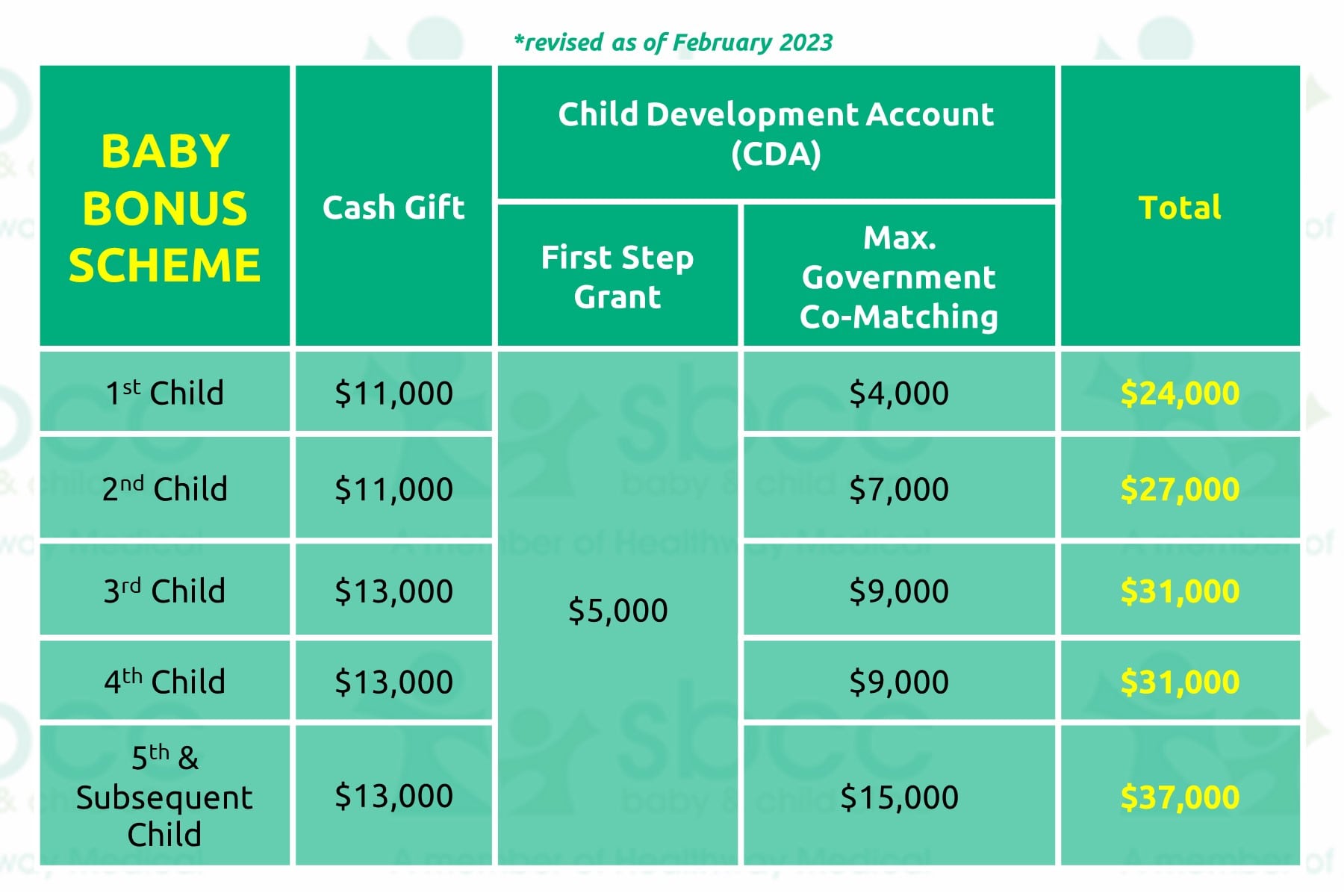

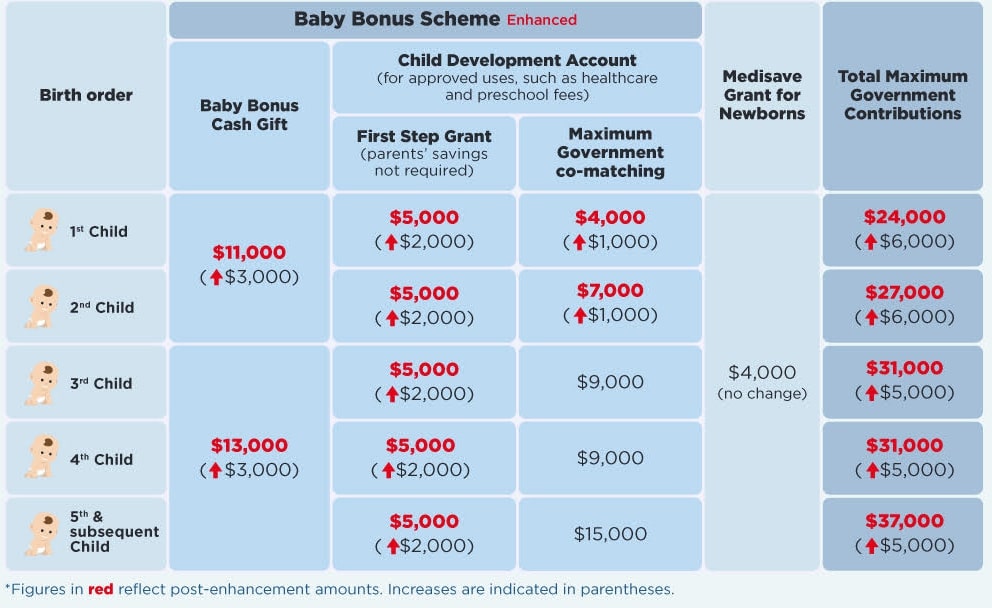

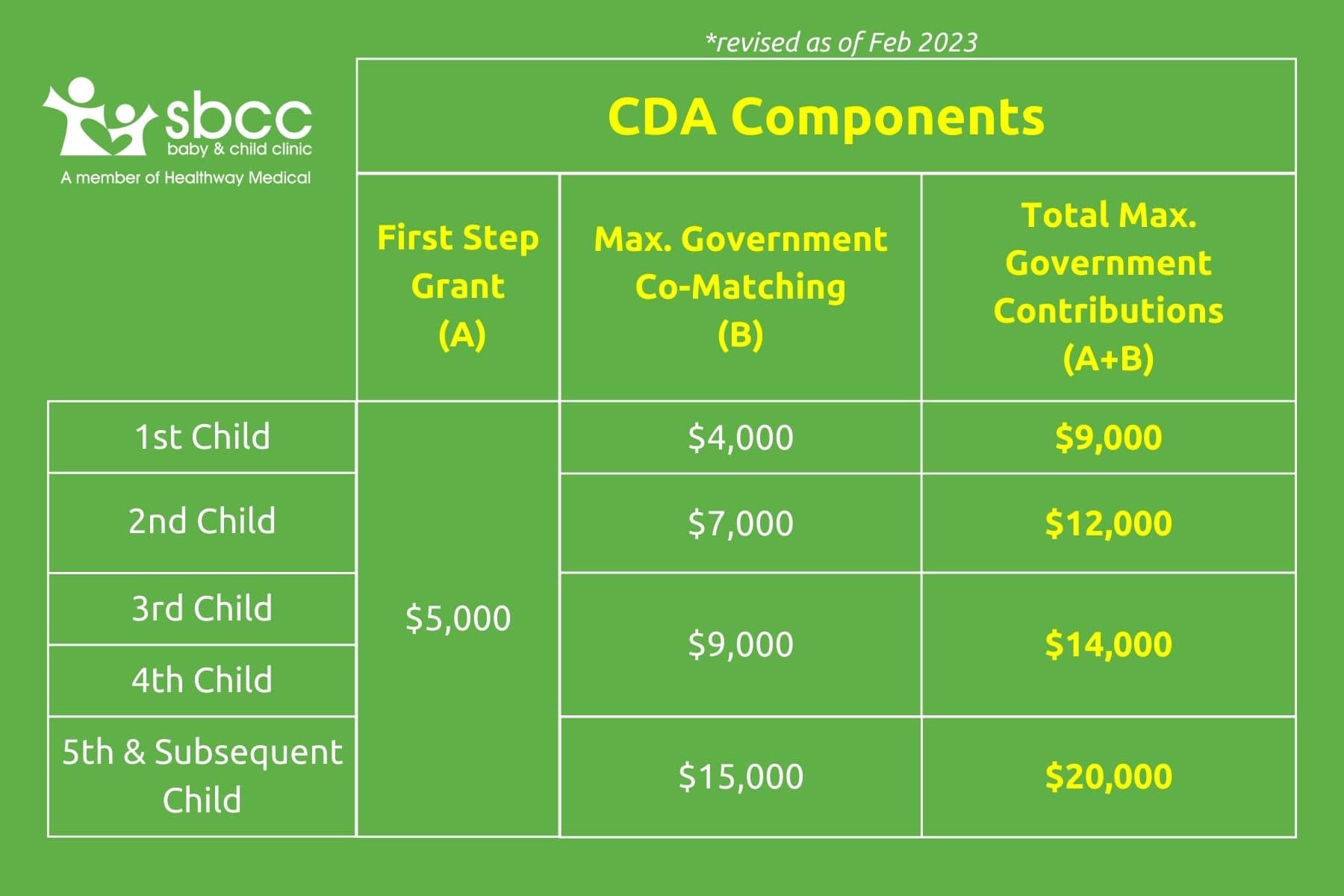

Newborn upfront payment and newborn supplement. Singapore's baby bonus scheme has been enhanced. Family tax benefit this is a 2 part payment that helps with the cost of raising children.

Eligible for family tax benefit (ftb) part a. The amount you get depends on how many children you have and your family’s. To be eligible for the baby bonus, you must:

Sandy pramuji and timothy kang. Have an estimated family income of $75,000 or less in the six months after the birth, adoption or taking care of the. The amount you get depends on how many children you have and your family’s income.