Who Else Wants Info About How To Claim Child Tax Allowance

How much is the 2024 child tax credit?

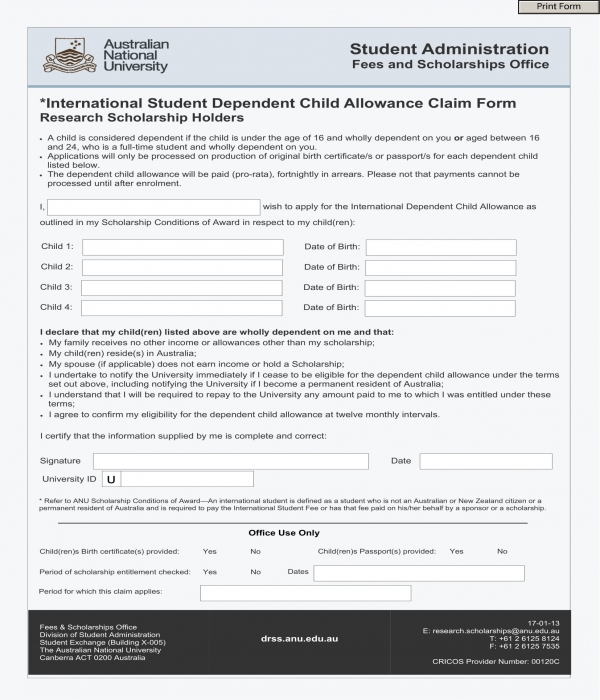

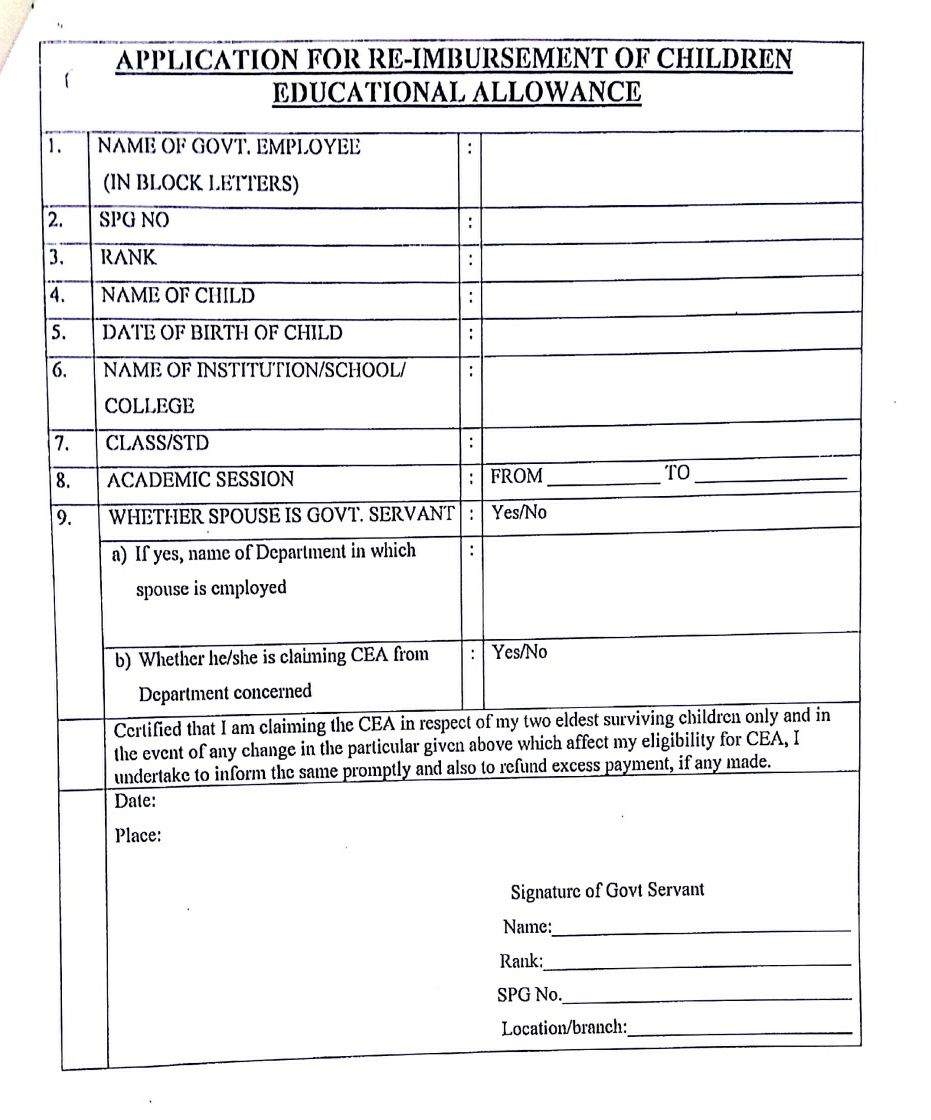

How to claim child tax allowance. You can now apply for or change your claim for child benefit online on the gov.uk site or through the hmrc app. Use this service to make a claim for child benefit or to add another child to an existing claim. You might need to download, print and send your completed.

Work out how many children you can claim tax credits for. You can also fill out a claim form. If you qualify for universal credit and have childcare costs, you might be able to claim back up to 85% of eligible childcare costs.

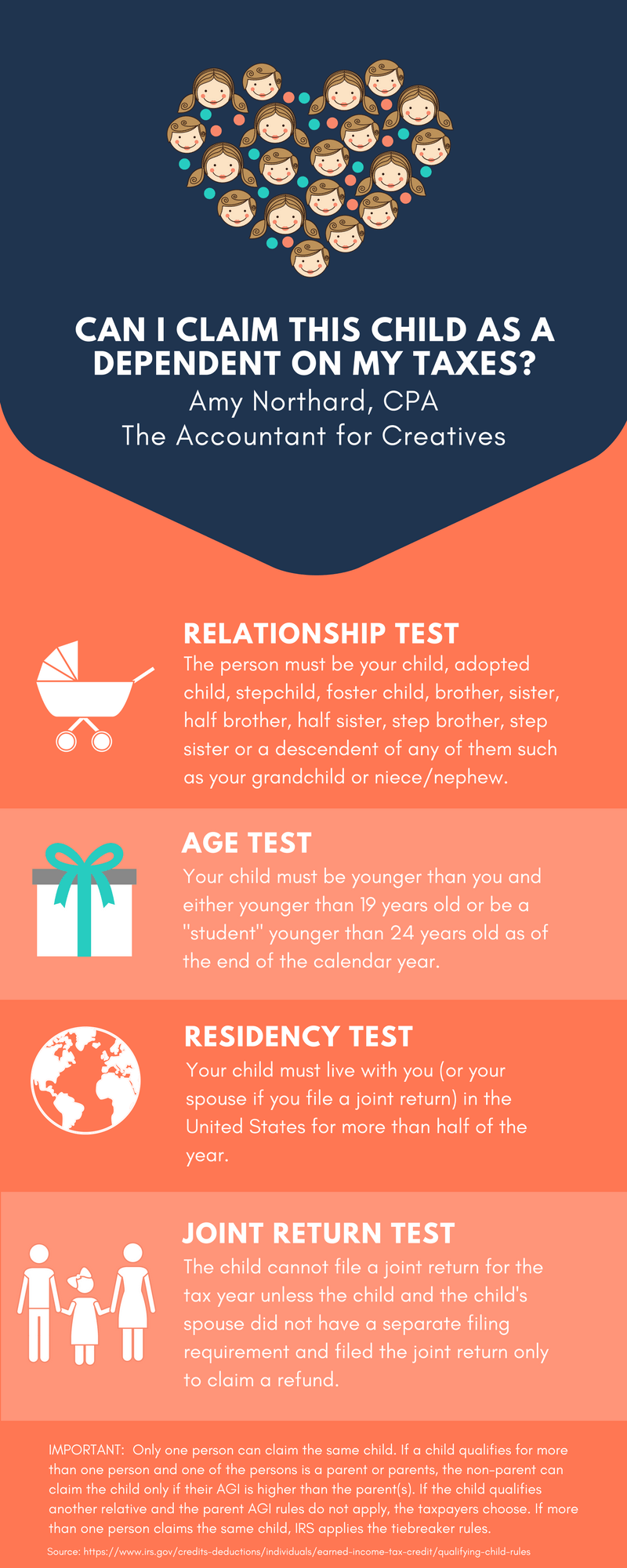

Find out how to claim child benefit and who can claim tax allowances for child care expenses. At the start of employment or after a. If you (or your partner) earn £50,000 a year or under, you can claim the full entitlement of child benefit if the child you're applying for lives with you, or if you're.

Ultimately, the number of allowances depended on your tax strategy and. Benefits benefits if you have children child benefit for people earning £50,000+ if either you or your partner earns more than £50,000 a year before tax, you’ll have to pay back. Get national insurance credits, which count towards your state pension get your child a national insurance number without them.

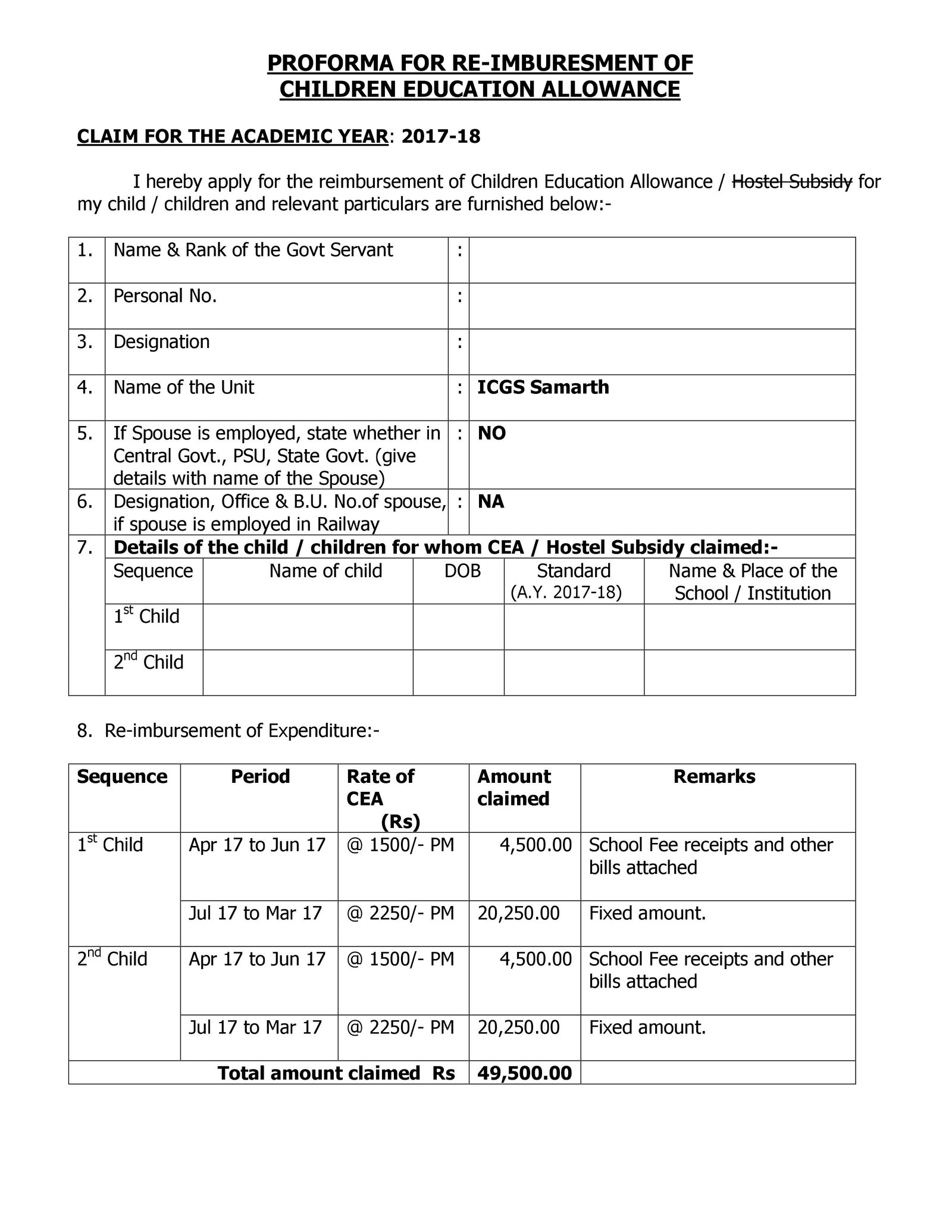

If your children were all born before 6 april 2017, you can claim child tax credits for each child. In 2022/23 this is up to a maximum of £646.35 for. Child benefit is paid to anyone working in thailand who has made.

Faqs how many allowances should i claim? The filing threshold is much lower for other types of income. Only a portion is refundable this.

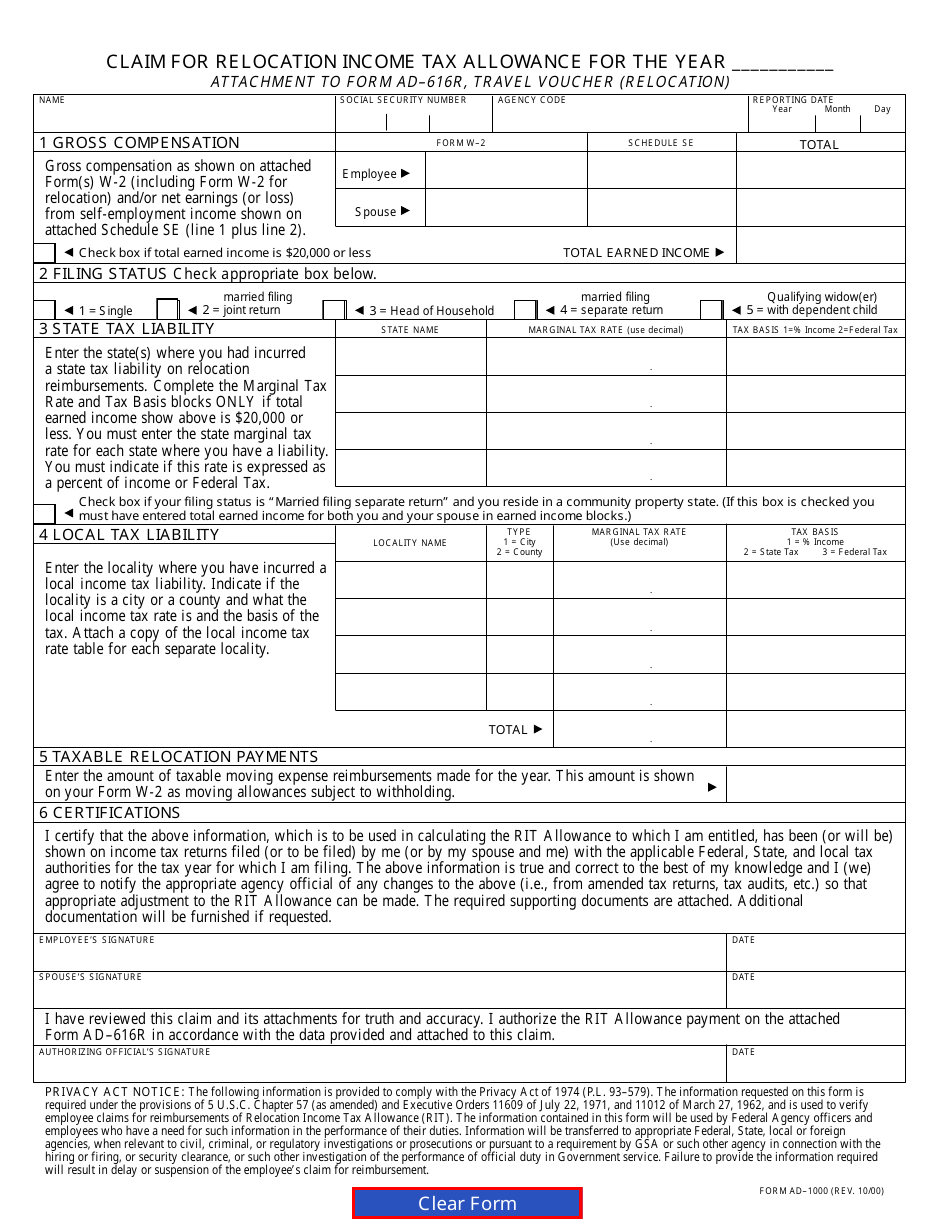

In work on sick leave or annual leave on shared. Use our tax calculator to see how allowances for children reduce your tax. You need to fill in the claim form if you want to:

If your first or second. This is up from £21.80 a week for your. To work out your claim, hmrc looks at:

So if you had yourself, a spouse and two children, you may claim four allowances. The maximum amount per child you'll receive on your tax. If you cannot apply for child tax credit,.

According to existing provisions under sections 80c, 80ccc,. How to claim responsibility for a child overview you can only make a claim for child tax credit if you already get working tax credit. How to claim child benefit.

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)